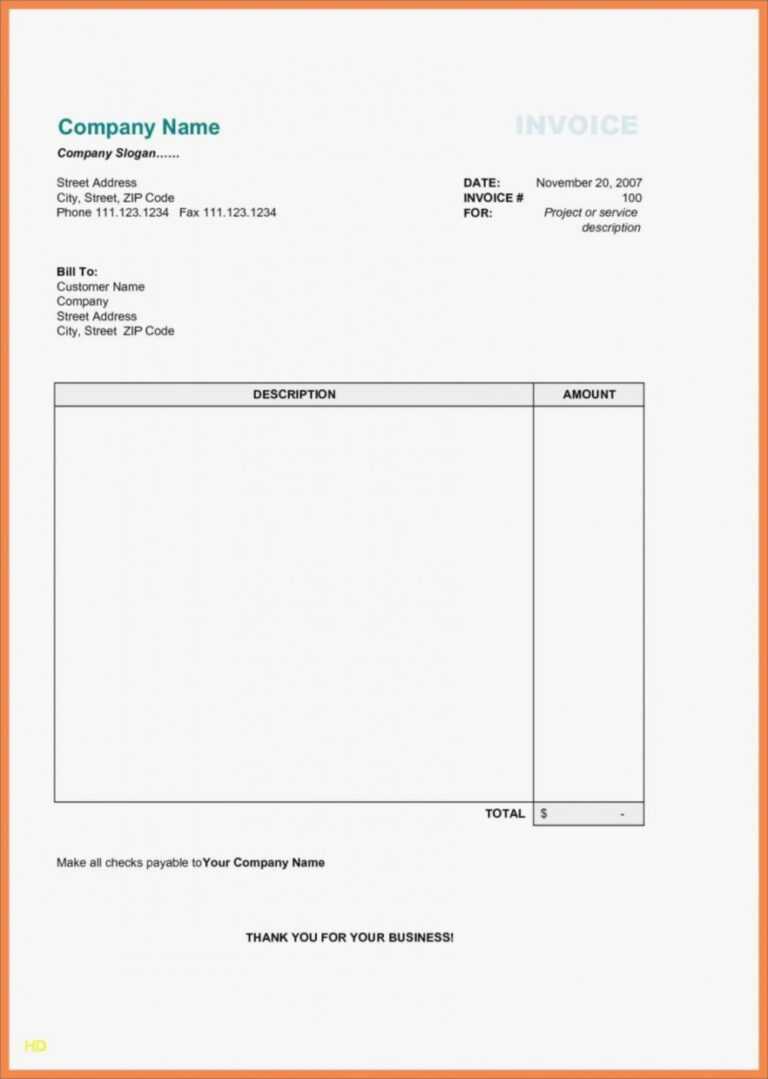

Discount Section: This section should contain details of any discounts or deductions given, along with the net taxable value.Product/Service Details Section: This section should contain a description of the goods or services supplied, the number of goods or services supplied, the unit of measurement, the taxable value, and the applicable GST rate.Invoice Details Section: This section should contain the invoice number, date of issue, and date of supply (if different from the invoice date).Customer Section: This section should contain the name, address, and GSTIN or Unique Identification Number (UIN) of the recipient (if registered under GST).Header Section: This section should contain the word "Invoice" prominently displayed at the top of the document, along with the name, address, and GSTIN of the supplier.

0 kommentar(er)

0 kommentar(er)